Blog

How to unlock biodiversity finance to combat global biodiversity crisis

Biodiversity loss and ecosystem collapse are among the most pressing challenges of our time. As the world grapples with an unprecedented biodiversity crisis, a new report from the Transformative Change for Biodiversity and Equity (TCforBE) Project emphasises the urgent need for robust financial instruments to help combat this loss and foster equitable recovery.

Published in February 2025, the report “Finance instruments and related regulations” provides an assessment of global and EU biodiversity initiatives, key levers for change, the biodiversity finance landscape and current financial instruments. It also profiles key investment and finance policy options in the EU biodiversity strategy.

The report underscores substantial gaps in biodiversity financing and policy implementation and calls for an intensified commitment from both public and private sectors to bridge the funding gap. The authors critically examine the strengths and weaknesses of EU policy levers impacting biodiversity finance, highlighting significant gaps such as the need for clearer regulatory frameworks and the alignment of financial incentives. Dr Theresa Harrer, the report’s lead author said[JM1][TH2][JM3]: ‘The report suggests that more robust regulatory mandates could significantly enhance the development and deployment of private biodiversity finance instruments.’

The authors outline global and EU financial sector initiatives which can drive change through strategic investments in biodiversity conservation. Such initiatives include the Kunming-Montreal Global Biodiversity Framework and, the European Green Deal which, through the EU Biodiversity Strategy, aims to lead the way towards an ecologically sustainable future.

Several financial instruments are available to support biodiversity. The report evaluates their effectiveness in leveraging economic incentives for conservation. Public biodiversity finance mechanisms such as biodiversity-related fees, taxes, and charges, and private mechanisms like philanthropy and impact investing, are debated. Notably, despite growing funds, the authors point out that financial contributions fall short of the annual US$824 billion needed for nature restoration globally. This gap highlights the pressing need for new finance and effectively deploying existing instruments.

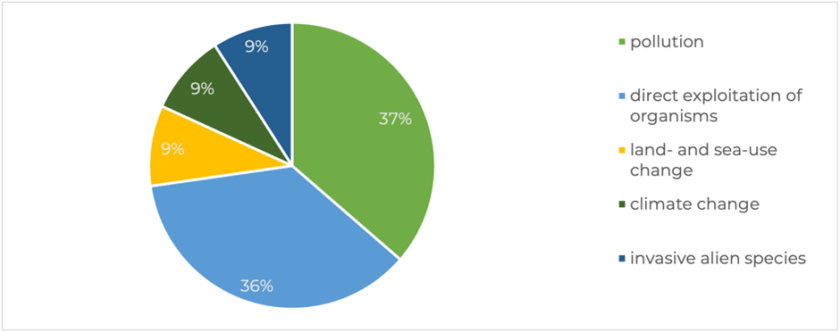

The report also critically reviews the effectiveness of over 100 strategic biodiversity-related actions by the EU in achieving its conservation objectives. These actions are evaluated for their alignment with the EU’s biodiversity strategy goals and effectiveness in addressing the root causes of biodiversity loss. For example, with a focus on pollution reduction and direct exploitation of organisms, the EU’s policy is misaligned with scientific evidence. Professor Othmar Lehner who coauthored the report explained[JM4][TH5]: “This report reveals a dynamic biodiversity policy and finance landscape, striving to meet the needs required to mitigate biodiversity loss effectively. However, despite significant advancements in both policy and finance, it also highlights a substantial gap between current efforts and those required to truly effect change. For example, scientific consensus sees the land use and the agri-food sector as major drivers, yet these are rarely targeted by policies and actions, potentially because of political pressure.”

The report suggests that more robust regulatory mandates and a deeper integration of biodiversity goals could significantly enhance the impact of EU biodiversity policies. quote on the significance of your findings e.g. for the broader EU biodiversity strategy?

The authors recommend enhancing interactions between public and private financing mechanisms. Leveraging public funds to de-risk private investments can catalyse more substantial flows of private capital into biodiversity projects.

Innovation in financial products is crucial. Beyond traditional instruments, there should be an exploration of hybrid financial tools such as blended finance, which combines grants with loans and equity from private and public sources to fund biodiversity initiatives effectively.

To ensure that financial flows are both substantial and sustainable, more robust regulatory frameworks must be established. These frameworks (e.g., the European green bond standard) should not only incentivize investments in biodiversity-positive projects but also penalize non-compliance and harmful practices effectively.